Exploring the Marketing Impact of Emerging Trends in Digital Payments 2024

Last updated on December 21, 2024 by Digital Sky Star

"The most important thing in business is innovation, and trends and technologies are at its heart."

Digital payments are everywhere now. We use our phones to pay for almost everything — from groceries to coffee. This shift isn't just convenience, it's changing how we shop and interact with businesses. Digital payments offer a whole new way for companies to connect with customers.

Think about those personalized offers you see online or the quick and easy checkouts on your favorite apps. And for businesses and marketers, understanding these changes is key to staying competitive.

So, let’s explore how digital payments are changing the marketing world. We’ll talk about the major trends and how businesses can use them to their advantage.

5 Trends in Digital Payments that Change Marketing

1. Mobile Wallets and In-App Payments

Mobile wallets, like Apple Pay, Google Pay, and Samsung Pay, have changed how we pay for goods and services. These digital wallets store your payment information securely — allowing you to tap your phone at checkout or scan a QR code for a quick and easy transaction. The convenience factor alone has made mobile wallets incredibly popular, but they offer more than just ease of use.

Like, they help businesses with the ability to collect valuable data. When customers use mobile wallets, companies can track their spending habits, preferred stores, and even their location. This data allows for highly targeted marketing campaigns, sending personalized offers and promotions directly to customers' phones.

In-app payments have also become powerful for businesses. When you buy something directly through an app, it's a smooth experience that keeps you engaged and encourages you to spend more. Plus, the app can track your browsing and purchasing behavior, allowing businesses to recommend other products or services you might be interested in. This personalization can boost sales and customer loyalty, confirms Khashayar Shahnazari, Chief Executive Officer at FinlyWealth.

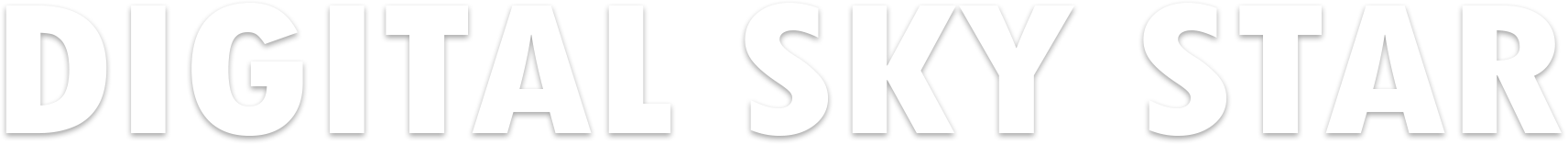

Let’s take Amazon as an example. They change online shopping with its one-click checkout feature — powered by digital payments.

This streamlined checkout process eliminates the need to enter payment information repeatedly, making it easier and faster for customers to complete purchases. This convenience has contributed to Amazon's success, driving sales and customer loyalty.

2. Contactless Payments

Have you ever simply tapped your card or phone on a reader to pay? That's the beauty of contactless payments. This technology has exploded in popularity, especially during the pandemic when we all sought ways to minimize contact. But even beyond hygiene, contactless payments offer a faster, smoother checkout experience that customers love.

From a marketing perspective, contactless payments are a win-win. They reduce friction at checkout, which leads to happier customers and fewer abandoned carts. But they also offer a treasure of data. By analyzing contactless payment data, businesses can gain insights into peak shopping times, popular products, and even customer demographics, says Noam Friedman, CMO of Tradeit.

Plus, contactless payments open the door to innovative marketing tactics. Imagine receiving a special offer on your phone as you tap to pay at your favorite store, or being able to collect loyalty points with a simple tap. Contactless payments are not just a trend — they're a way that's reshaping the way businesses connect with their customers.

3. Buy Now, Pay Later (BNPL)

“Buy now, pay later (BNPL) services have taken the shopping world by storm. These platforms, like Klarna, Affirm, and Afterpay, let you split your purchase into smaller, interest-free installments. This flexibility appeals to budget-conscious shoppers and those who want to avoid credit card debt.

For businesses, BNPL reduces cart abandonment rates, as customers are more likely to complete a purchase if they know they can pay over time. It can also increase average order values, as shoppers may be tempted to add more to their carts when the cost is spread out,” says Don Evans, CEO of Crewe Foundation Services.

But BNPL's impact goes beyond just sales. It's also about building customer relationships. By offering a flexible payment option, businesses show that they understand and cater to their customers' financial needs. This builds trust and loyalty, leading to repeat purchases and positive word-of-mouth.

BNPL is also a goldmine of data. By analyzing purchase patterns and payment behavior, businesses can gain valuable insights into customer preferences and financial habits. This information can be used to create even more targeted marketing campaigns and tailor product offerings to specific customer segments.

4. Cryptocurrency and Blockchain

Cryptocurrency and blockchain technology are shaking up the financial world, and their impact on marketing is just beginning to unfold. Cryptocurrencies like Bitcoin and Ethereum offer a decentralized, secure, and borderless way to make payments.

One of the most exciting aspects of cryptocurrency for businesses is the potential for direct, peer-to-peer transactions. This eliminates the need for intermediaries like banks, reducing fees and allowing for faster, more efficient payments. From a marketing perspective, this could lead to new ways to engage with customers, such as offering exclusive discounts or rewards for using cryptocurrency.

Blockchain, the technology behind cryptocurrency, offers even more possibilities. Its decentralized nature and tamper-proof record-keeping make it ideal for creating transparent and secure loyalty programs, tracking the provenance of products, and even verifying the authenticity of digital assets.

But cryptocurrency and blockchain are still growing, and there are challenges to overcome. The volatility of cryptocurrency prices, regulatory uncertainty, and the need for consumer education are all factors that businesses need to consider.

5. Biometric Authentication

Forget PINs and passwords — biometric authentication is the next frontier in secure payments. Fingerprint scanning and facial recognition are becoming common ways to verify your identity and authorize transactions.

For consumers, this means faster, more convenient checkouts. A quick touch or glance is all it takes to pay, eliminating the need to fumble for cards or remember passwords. This frictionless experience can improve customer satisfaction and encourage repeat business.

Aleksander Nowak, Research Analyst at Highticket.io says, “From a marketing standpoint, biometric authentication can be a powerful tool for building trust and loyalty. Customers are more likely to trust brands that prioritize security and protect their personal information. By implementing biometric authentication, businesses can show their commitment to safeguarding customer data.”

Plus, biometric data can be used to personalize the shopping experience. Imagine walking into a store and being greeted by name, with personalized recommendations based on your past purchases. Biometric authentication can make this a reality, creating a more engaging and tailored shopping journey.

Winning Marketing Strategies in the Digital Payments

Here are the strategies.

1. Data-Driven Insights

Digital payments provide a wealth of data that businesses can use to create highly targeted and personalized marketing campaigns. By analyzing customer transaction data, companies can gain valuable insights into purchasing behavior, preferences, and demographics. This information can be used to tailor marketing messages, offers, and promotions to specific customer segments.

This smooth integration of digital payments with a loyalty program has resulted in increased consumer spending and a boost in app usage.

Dan Close, Founder and CEO at We Buy Houses in Kentucky says, “Data-driven insights also enable businesses to optimize their marketing channels and timing. By understanding when and where customers are most likely to make purchases, companies can strategically time their marketing campaigns and focus their efforts on the most effective platforms.”

2. Loyalty Programs and Rewards

Loyalty programs have long been a staple of marketing, but digital payments are taking them to the next level. By integrating loyalty rewards with digital wallets and payment apps, businesses can make it easier than ever for customers to earn and redeem points.

Think about how satisfying it is to see your points accumulate every time you tap your phone to pay. This instant gratification not only makes customers feel valued, but it also incentivizes them to keep coming back.

Digital loyalty programs offer businesses a wealth of data. They can track customer spending habits, identify their most loyal customers, and tailor rewards to individual preferences.

For example, Starbucks mobile app shows how digital payments can drive customer engagement and loyalty.

Customers can order and pay for their drinks ahead of time, earn rewards through the Starbucks Rewards program, and receive personalized offers based on their purchase history.

3. Social Media and Influencer Marketing

Social media platforms are a natural fit for promoting digital payments. These platforms are where consumers spend a lot of time, making them ideal channels for reaching a wide audience and generating buzz around new payment options, explains Danny Jay, Founder of Long Weekend.

Businesses can use social media to educate consumers about the benefits of digital payments, showcasing their convenience, security, and rewards. Engaging content, such as how-to videos, customer testimonials, and contests, can spark interest and drive adoption.

Influencer marketing is also good in the digital payments space. By partnering with popular social media figures, businesses can tap into their established audiences and use their credibility to promote digital payment solutions. When an influencer you trust raves about the convenience of a mobile wallet or the benefits of a BNPL service, you're more likely to give it a try.

Moreover, social media and influencer marketing can help to humanize digital payments, making them more relatable and less intimidating for consumers. By showcasing real people using these payment methods in their everyday lives, businesses can create a sense of familiarity and trust.

4. Omnichannel Marketing

Today's consumers move between online and offline channels — expecting a consistent experience no matter where they interact with a brand. Digital payments are a key enabler of omnichannel marketing, allowing businesses to create a unified customer journey across all touchpoints.

Imagine browsing for shoes on your phone, adding a pair to your cart, and then heading to the store to try them on. With a mobile wallet, you can effortlessly complete the purchase in-store, and the retailer can track your entire journey, from online browsing to in-store purchase. This valuable data allows for a more personalized shopping experience, whether you're online or offline.

Omnichannel marketing is also about delivering consistent messaging and promotions across all channels.

For example, Nike has used omnichannel marketing by integrating digital payments across its online and offline channels. Customers can browse products online, reserve items for in-store pickup, and pay using their mobile wallet at checkout.

This integrated approach provides a convenient and personalized shopping experience — whether customers are shopping online or in-store.

5. Location-Based Marketing

With digital payments, your phone becomes more than just a wallet — it's a map to personalized deals and offers. Businesses can use location data from mobile wallets and payment apps to send you targeted promotions when you're near their stores or in specific areas, says Martin Seeley, CEO of Mattress Next Day.

Imagine walking past your favorite coffee shop and receiving a notification for a buy-one-get-one-free offer on your phone. Or maybe you're strolling through a mall and a pop-up ad appears for a discount at a store you've been meaning to check out. This is location-based marketing in action, and it's changing the way businesses interact with customers in the real world.

By using location data, businesses can make their marketing messages more relevant and timely. They can target specific demographics based on where they live, work, or frequent, and deliver offers that are tailored to their interests. This not only increases the likelihood of engagement but also enhances the overall customer experience.

Location-based marketing is particularly effective for brick-and-mortar businesses, as it helps drive foot traffic and encourages impulse purchases. But it's not just for physical stores. Restaurants can use it to promote daily specials, event venues can send out last-minute ticket offers, and even service providers like hair salons can entice customers with location-based discounts.

Challenges and Considerations

While digital payments offer a wealth of opportunities for businesses and consumers alike, they also come with their fair share of challenges and considerations. As we use financial transactions, it's crucial to be aware of the pitfalls and take steps to mitigate the risks.

1. Security Concerns

Security is perhaps the most pressing concern when it comes to digital payments. The digital nature of these transactions makes them vulnerable to fraud, data breaches, and cyberattacks. Hackers are looking for ways to exploit vulnerabilities in payment systems, putting sensitive financial information at risk.

To address these concerns, businesses and payment providers are investing heavily in security measures. Encryption, tokenization, and two-factor authentication are just a few of the technologies being used to protect customer data. Plus, regulatory bodies are imposing stricter security standards on businesses that handle digital payments.

According to David Martinez, VP Enterprise & OEM Accounts at Cybernet Manufacturing, “As a consumer, you can also take steps to protect yourself. Be cautious about sharing your payment information online, use strong passwords, and be wary of phishing scams. By staying vigilant and practicing safe online habits, you can minimize your risk of becoming a victim of fraud.”

2. Regulatory Landscape

The world of digital payments is constantly growing, and so are the regulations that govern it. Governments and financial institutions are working to establish clear rules and guidelines to ensure the safety and security of digital transactions.

For businesses, keeping up with these ever-changing regulations can be a challenge. It requires a thorough understanding of the legal landscape and a commitment to compliance. Failure to comply with regulations can result in hefty fines, reputational damage, and even legal action.

Consumers also need to be aware of the regulatory framework surrounding digital payments. Understanding your rights and responsibilities as a consumer can help you make informed decisions about how you use digital payment methods and protect yourself from potential risks, says Distasio Personal Injury Lawyers.

3. Technological Infrastructure

The success of digital payments hinges on a robust and reliable technological infrastructure. This includes everything from secure payment gateways and processing systems to user-friendly interfaces and mobile apps.

Businesses need to invest in the right technology to ensure smooth and secure transactions for their customers. This may involve partnering with reputable payment providers, implementing the latest security protocols, and regularly updating their systems to stay ahead of evolving threats.

For consumers, a reliable technological infrastructure means being able to access and use digital payment methods easily and without interruption. It also means having confidence that their transactions are secure and their personal information is protected.

4. Consumer Adoption

While digital payments are becoming popular, there's still a portion of the population that is hesitant to grab them. Concerns about security, privacy, and the learning curve associated with new technologies are some of the main barriers to adoption.

To overcome these challenges, businesses need to focus on educating consumers about the benefits of digital payments and addressing their concerns head-on. This could involve offering incentives for using digital payment methods, providing clear instructions and tutorials, and highlighting the security measures that are in place to protect customer data.

- David Carter, Personal Injury Attorney at Gould Cooksey Fennel

Wrap Up

So, it's clear that digital payments aren't just a passing trend — they're here to stay and they're changing the way we shop and interact with brands.

For businesses, these changes mean a new way to reach customers and build lasting relationships. While there are challenges ahead, the possibilities are exciting. The future of marketing is digital, and it's happening right now.

"Technology is best when it brings people together." – Matt Mullenweg

If you would like more information about the Exploring the Marketing Impact of Emerging Trends in Digital Payments 2024, please send us an email.

Written by Digital Sky Star

Trends and Technologies

Trends and Technologies are shaping the future with innovations in AI, IoT, blockchain, and more. Stay updated on the latest advancements transforming industries worldwide. Explore cutting-edge tools, insights, and breakthroughs that drive progress and efficiency. Unlock potential, embrace change, and stay ahead in the ever-evolving tech landscape.